SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a)

of the Securities Exchange Act of 1934

Filed by the Registrantx

Filed by a Party other than the Registranto

Check the Appropriate Box:

| UNITED STATES | |||

| SECURITIES AND EXCHANGE COMMISSION | |||

| Washington, D.C. 20549 | |||

| SCHEDULE 14A | |||

| Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 | |||

| Filed by the Registrant x | |||

| Filed by a Party other than the Registrant o | |||

| Check the appropriate box: | |||

| o | Preliminary Proxy Statement | ||

| o | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |||

| x | Definitive Proxy Statement | |||

| o | Definitive Additional Materials | |||

| o | Soliciting Material | |||

VUZIX CORPORATION

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| VUZIX CORPORATION | |||

| (Name of Registrant as Specified In Its Charter) | |||

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) | |||

| Copies to: Gregory Sichenzia, Esq. Tara Guarneri-Ferrara, Esq. Sichenzia Ross Friedman Ference LLP 61 Broadway, 32nd Floor New York, NY 10006 (212) 930-9700 gischenzia@srff.com tguarneri-ferrara@srff.com | |||

| Payment of Filing Fee (Check the appropriate box): | |||

| x | No fee | ||

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies: | ||

| (2) | Aggregate number of securities to which transaction applies: | ||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 | ||

| (4) | Proposed maximum aggregate value of transaction: | ||

| (5) | Total fee paid: | ||

| o | Fee paid previously with preliminary | ||

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | ||

| (1) | Amount Previously | ||

| (2) | Form, Schedule or Registration Statement No.: | ||

| (3) | Filing Party: | ||

| (4) | Date | ||

VUZIX CORPORATION

75 Town Centre Drive2166 Brighton Henrietta Townline Road

Rochester, New YorkNY 14623

(585) 359-5900

NOTICE OF ANNUALSPECIAL MEETING OF STOCKHOLDERS

To Be Held On

June 22,

November 30, 2012

Dear Stockholder:To Our Stockholders:

You are cordially invited to attend the annual meetingA Special Meeting of stockholdersStockholders of Vuzix Corporation.The meetingCorporation, a Delaware corporation (the “Company”, “we”, “us” or “our”), will be held on Friday, June 22,November 30, 2012 at 11:00 a.m. (local time), local time, at the DoubletreeDoubleTree Hotel, 1111 Jefferson Road, Rochester, New York,NY 14623, for the following purposes:

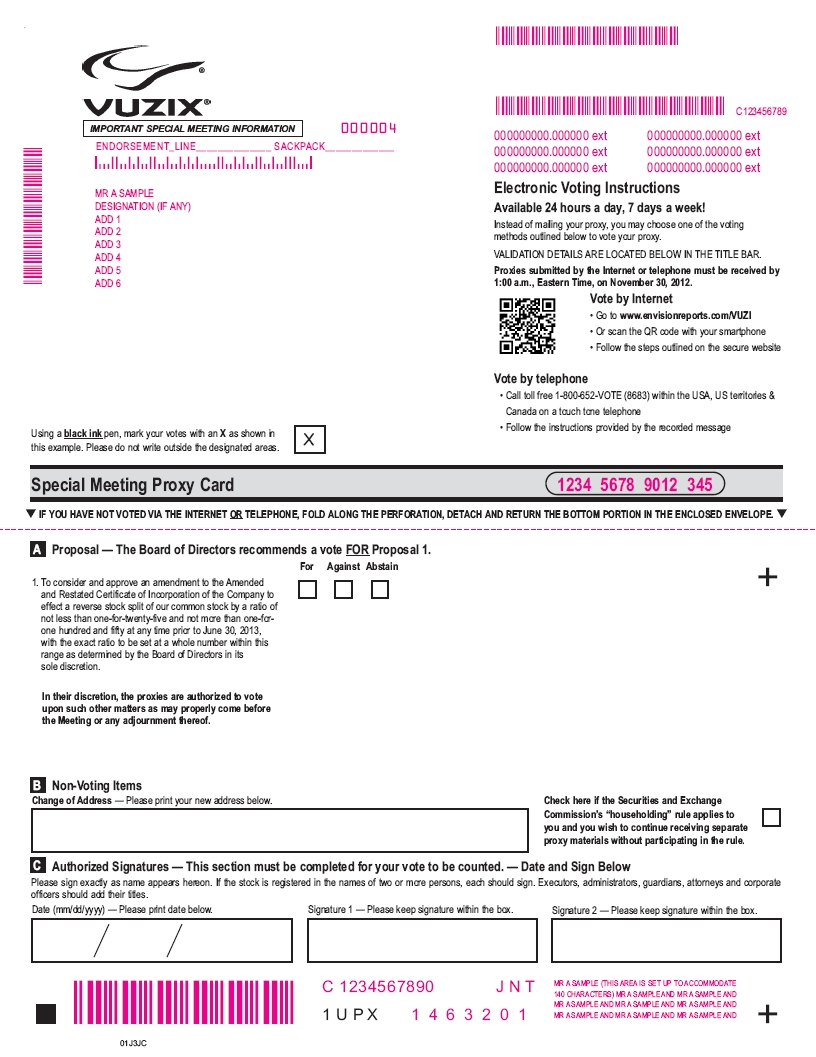

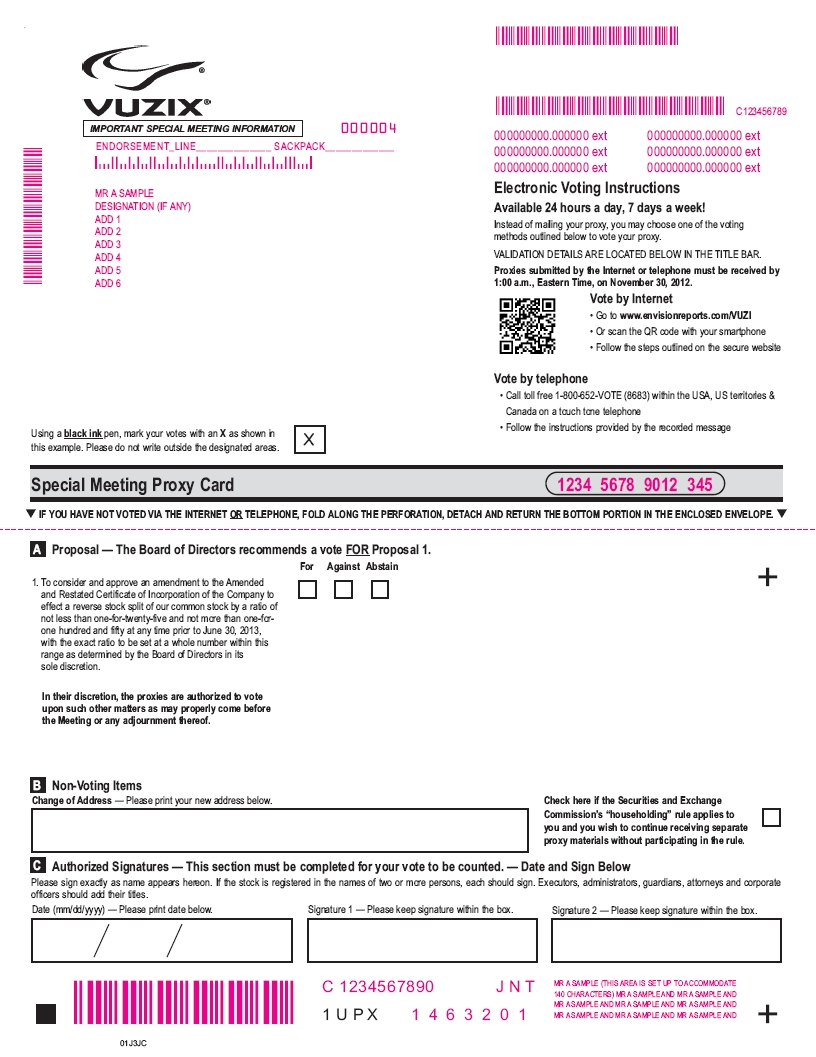

1. To consider and act upon a proposal of an amendment to our Amended and Restated Certificate of Incorporation (“Certificate of Incorporation”) to effect a reverse stock split (the “Reverse Stock Split”) of our issued and outstanding common stock by a ratio of not less than one-for-twenty-five and not more than one-for-one hundred and fifty at any time prior to June 30, 2013, with the exact ratio to be set at a whole number within this range as determined by the Board of Directors in its sole discretion; and

2. To act on such other matters as may properly come before the meeting or any adjournment thereof. Only holders of record of the Company’s common stock as reflected on the stock transfer books of the Company |

The record date for the annual meeting is May 25, 2012. Only stockholders of record at the close of business on that date mayOctober 24, 2012, will be entitled to notice of and to vote at the meetingmeeting. All stockholders are cordially invited to attend the meeting.

YOUR VOTE IS IMPORTANT. PLEASE COMPLETE AND RETURN THE ENCLOSED PROXY IN THE ENVELOPE PROVIDED WHETHER OR NOT YOU INTEND TO BE PRESENT AT THE MEETING IN PERSON. ALTERNATELY, YOU MAY WISH TO PROVIDE YOUR RESPONSE BY TELEPHONE OR ELECTRONICALLY THROUGH THE INTERNET BY FOLLOWING THE INSTRUCTIONS SET OUT ON THE ENCLOSED PROXY CARD. IF YOU ATTEND THE MEETING, YOU MAY CONTINUE TO HAVE YOUR SHARES VOTED AS INSTRUCTED IN THE PROXY OR YOU MAY WITHDRAW YOUR PROXY AT THE MEETING AND VOTE YOUR SHARES IN PERSON.

This proxy statement and form of proxy are being sent to our stockholders on or any adjournment thereof. Our transfer books will not be closed.about October 29, 2012.

| By Order of the Board of Directors, | |

| /s/Steven D.Ward | |

| Steven D. Ward, Secretary |

Rochester, New YorkIT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE MEETING. PLEASE SIGN, DATE AND MAIL THE ENCLOSED PROXY IN THE ENCLOSED ENVELOPE WHICH REQUIRES NO POSTAGE IN THE UNITED STATES.

You are cordially invited to attend the meeting in person. Whether or not you expect to attend the meeting, please complete, date, sign and return the enclosed proxy as promptly as possible in order to ensure your representation at the meeting. Your vote is important, no matter how many shares you owned on the record date. A return envelope is enclosed for your convenience and needs no postage if mailed in the United States. If you wish, you may vote via the Internet or telephone, instructions for doing so are attached to this Proxy Statement. Even if you have voted by proxy or via the Internet, you may still vote in person if you attend the meeting. Please note, however, that if your shares are held of record by a broker, bank or other nominee and you wish to vote at the meeting, you must obtain a proxy issued in your name from that record holder.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL MEETING TO BE HELD ON JUNE 22, 2012.

Our proxy statement and annual report to stockholders, which are enclosed with this mailing, are also available at www.edocumentview.com/vzx

Table of Contents

VUZIX CORPORATION

75 Town Centre Drive2166 Brighton Henrietta Townline Road

Rochester, New YorkNY 14623

(585) 359-5900

PROXY STATEMENT

FOR

The Board of Directors of Vuzix Corporation, a Delaware corporation (the “Company”, “we”, “us”, or “our”) is soliciting proxies in the form enclosed with this proxy statement for use at the Company’s Special Meeting of Stockholders to be held on November 30, 2012 ANNUAL MEETING OF STOCKHOLDERSat 11:00 a.m. local time, at the DoubleTree Hotel, 1111 Jefferson Road, Rochester, NY 14623, and any adjournments thereof (the “Meeting”).

ThisGENERAL INFORMATION ABOUT VOTING

How Proxies Work

The Company’s Board of Directors is asking for your proxy. Giving us your proxy statement is furnishedmeans that you authorize us to shareholdersvote your shares at the Meeting in connection with the solicitation of proxiesmanner that you direct, or if you do not direct us, in the manner as recommended by the Board of Directors of Vuzix Corporation. (the "Company") in connection with the annual meeting of shareholdersthis proxy statement.

Who May Vote

Holders of the Company to be held on June 22, 2012Company’s common stock, par value $0.001 per share (the “Common Stock”), at 11:00 a.m., local time, at the Doubletree Hotel, 1111 Jefferson Road, Rochester, New York, 14623 (the "Meeting").A copy of the Company's Annual Report on Form 10-K filed with the Securities and Exchange Commission ("SEC") is available without charge upon written request to the Company's Secretary at the Company's corporate offices, or from the SEC's website at www.sec.gov.

Additional copies of this proxy statement and the annual report to shareholders, notice of meeting, form of proxy, and directions to be able to attend the meeting and vote in person, may be obtained from the Company's Secretary, 75 Town Centre Drive, Rochester, New York 14623. This proxy statement, together with the accompanying annual report to shareholders and form of proxy will first be sent to Shareholders on or about May 31, 2012 and will also be available on the Company’s website and at the Company’s transfer agent at www.envisionreports.com/VZX.

Important Notice Regarding the Availability of Proxy Materials

for the Annual Meeting of Shareholders to be Held on June 22, 2012

This proxy statement, form of proxy, and the accompanying annual report to shareholders are available at www.vuzix.com

SOLICITATION AND REVOCABILITY OF PROXIES

The enclosed proxy for the Meeting is being solicited by the directors of the Company. Shareholders of record may vote by mail, telephone, or via the Internet. The toll-free telephone number and Internet web site are listed on the enclosed proxy. If you vote by telephone or via the Internet you do not need to return your proxy card. If you choose to vote by mail, please mark, date and sign the proxy card, and then return it in the enclosed envelope (no postage is necessary if mailed within the United States). Any person giving a proxy may revoke it at any time prior to the exercise thereof by filing with the Secretary of the Company a written revocation or duly executed proxy bearing a later date. The proxy may also be revoked by a Shareholder attending the Meeting, withdrawing the proxy and voting in person.

The expense of preparing, printing and mailing the form of proxy and the material used in the solicitation thereof will be borne by the Company. In addition to solicitation by mail, proxies may be solicited by the directors, officers and regular employees of the Company (who will receive no additional compensation therefor) by means of personal interview, telephone or facsimile. It is anticipated that banks, brokerage houses and other institutions, custodians, nominees, fiduciaries or other record holders will be requested to forward the soliciting material to persons for whom they hold shares and to seek authority for the execution of proxies; in such cases, the Company will reimburse such holders for their charges and expenses.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The close of business on May 25,October 24, 2012 has been fixed as the record date for determination of the shareholdersare entitled to receive notice of and to vote their shares at the Meeting. On that dateAs of October 24, 2012, there were outstanding and entitled to vote 265,259,348 shares of common stock, par value $.001 perCommon Stock outstanding. Each share of the Company’s common stock (the "Common Stock") each of whichCommon Stock is entitled to one vote on each matter atproperly brought before the Meeting.

PursuantHow to the Company's bylaws, a plurality of the votes cast at the Meeting will be required to elect directors, and a majority of the votes cast at the Meeting will be required to ratify the appointment of the independent auditors for 2012.

The presence, in person or by properly executed proxy, of the holders of shares of Common Stock entitled to cast a majority of all the votes entitled to be cast at the Meeting is necessary to constitute a quorum. Holders of shares of Common Stock represented by a properly signed, dated and returned proxy will be treated as present at the Meeting for purposes of determining a quorum. Proxies relating to "street name" shares that are voted by brokers will be counted as shares present for purposes of determining the presence of a quorum, but will not be treated as votes cast at the Meeting as to any proposal as to which the brokers do not have voting instructions and discretion. These missing votes are known as “broker non-votes.”

QUESTIONS AND ANSWERS ABOUT THIS PROXY MATERIAL AND VOTING

Why am I receiving these materials?

We are sending you this proxy statement and the enclosed proxy card because the board of directors of Vuzix Corporation (“Vuzix”, the “Company”, “we”, “our”, “us”) is soliciting your proxy to vote at the 2012 Annual Meeting of Stockholders. We invite you to attend the annual meeting and request that you vote on the proposals described in this proxy statement. The meeting will be held on Friday, June 22, 2012 at 11:00 a.m. (local time) at the Doubletree Hotel, 1111 Jefferson Road, Rochester, New York. However, you do not need to attend the meeting to vote your shares. Instead, you may simply complete, date, sign and return the enclosed proxy card.

We are mailing this proxy statement, the accompanying proxy card, and our Annual Report to Stockholders for the year ended December 31, 2011 on or about May 31, 2012 to all stockholders of record entitled to vote at the annual meeting.

Who can vote at the annual meeting?

Only stockholders of record at the close of business on May 25, 2012, the record date for the meeting, will be entitled to vote at the annual meeting. On April 30, 2012, there were 265,259,348 of common stock outstanding and entitled to vote.Vote

StockholderStockholders of Record: Shares Registered in Your NameRecord.

If on May 25, 2012, your shares of Vuzix common stock were registered directly in your name with our transfer agent, Computershare Trust Company, then you are a stockholder of record. As a stockholder of record, you may vote in person atby any of the meeting or vote by proxy. Whether or not you plan to attend the meeting, we urge you to fill out and return the enclosed proxy card to ensure your vote is counted.following methods:

| · | Via the Internet. You may vote by proxy via the Internet by following the instructions provided on the enclosed Proxy Card. |

| · | By Telephone. You may vote by calling the toll free number found on the Proxy Card. |

| · | By Mail. You may vote by completing, signing, dating and returning your Proxy Card in the pre-addressed, postage-paid envelope provided. |

| · | In Person. You may attend and vote at the Special Meeting. The Company will give you a ballot when you arrive. |

Beneficial Owner:Owners of Shares RegisteredHeld in the Name of a Broker or BankStreet Name.

If on May 25, 2012, your shares of Vuzix common stock were held in an account at a brokerage firm, bank, dealer or other similar organization, then you are thea beneficial owner of shares held in “street name” and these proxy materials are being forwarded to you by that organization. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. As a beneficial owner, you have the right to direct your broker or other agent on how to vote the shares in your account. You are also invited to attend the annual meeting. However, since you are not the stockholder of record,street name, you may not vote your shares in person at the meeting unless you request and obtain a signed letter or other valid proxy from your broker or other agent.

What am I voting on?

There are two matters scheduled for a vote: the election of five (5) directors to serve until the 2013 Annual Meeting of Stockholders, and the ratificationby any of the selection of EFP Rotenberg, LLP as our independent registered public accounting firm for the year ending December 31, 2012. Our board of directors does not intend to bring any other matters before the meeting and is not aware of anyone else who will submit any other matters to be voted on. However, if any other matters properly come before the meeting, the people named on the proxy card, or their substitutes, will be authorized to vote on those matters in their own judgment.

How many votes do I have?

On each matter to be voted upon, you have one vote for each share of common stock you owned as of May 25, 2012.

What is the quorum requirement?

A quorum of stockholders is necessary to hold a valid meeting. A quorum will be present if at least a majority of the outstanding shares entitled to vote are present at the meeting. Your shares are counted as present at the meeting if:following methods:

| · | Via the Internet.You may vote by proxy via the Internet by following the instructions on the proxy card provided by your broker. |

| · | By Telephone. You may vote by proxy by calling the toll free number found on the vote instruction form. |

| · | By Mail. You may vote by proxy by filling out the vote instruction form and returning it in the pre-addressed, postage-paid envelope provided. |

| · | In Person. If you are |

Revoking a Proxy

You may revoke your proxy before it is voted by:

| · |

| · |

| · | voting by ballot at the |

The last vote you submit chronologically (by any means) will supersede your prior vote(s). Your attendance at the Meeting will not, by itself, revoke your proxy.

Quorum

In order to carry on the business of the Meeting, we must have a quorum. Holders of a majority of our capital stock issued and outstanding and entitled to vote at the meeting, represented in person or by proxy, shall constitute a quorum. Your shares will be counted towards the quorum only if you submit a valid proxy, have voted via the Internet, have voted via telephone, or vote in person at the meeting. Abstentions and broker non-votes will beare counted towardsas present and entitled to vote for purposes of determining a quorum. Treasury shares, which are shares owned by the quorum requirement. If there is no quorum,Company itself, are not voted and do not count for this purpose.

Votes Needed

The affirmative vote of the holders of a majority of the votes presentissued and outstanding shares of Common Stock entitled to vote at the meeting may adjournMeeting is required to approve the meetingamendment to another date.

How do I vote?

The procedures forour Certificate of Incorporation to effect the Reverse Stock Split of our issued and outstanding shares of Common Stock. Accordingly, shares which abstain from voting are set forth below:

Stockholder of Record: Shares Registered in Your Name

If you are a stockholder of record, you may vote in person at the annual meeting, vote by proxy using the enclosed proxy card, vote via the Internet or by telephone. Whether or not you planas to attend the meeting, we urge you to vote by proxy, via the Internet or by Telephone to ensure your vote is counted. You may still attend the meetingsuch matter, and vote in person if you have already voted by proxy, via the Internet or by telephone.

Beneficial Owner: Shares Registered in the Name of Broker or Bank

If you hold your shares held in “street name” and thus are a beneficial owner of shares registered in the name of your broker, bankby brokers or other agent, you must vote your shares in the manner prescribed by your broker or other nominee. Your broker or other nominee has enclosed or otherwise provided a voting instruction card for you to use in directing the broker or nominee how to vote your shares. Check the voting form used bynominees who indicate on their proxies that organization to see if it offers internet or telephone voting. To vote in person at the annual meeting, you must obtain a valid proxy from your broker, bank or other agent. Follow the instructions from your broker or bank included with these proxy materials, or contact your broker or bank to request a proxy form.

How are votes counted?

You may either vote “FOR” or “WITHHOLD” authority to vote for each nominee for the board of directors. You may vote “FOR”, “AGAINST” or “ABSTAIN” on any other proposals.

If you submit your proxy, vote via the Internet or by telephone but abstain from voting or withhold authority to vote on one of more matters, your shares will be counted as present at the meeting for the purpose of determining a quorum. Your shares also will be counted as present at the meeting for the purpose of calculating the vote on the particular matter with respect to which you abstained from voting or withheld authority to vote.

If you abstain from voting on a proposal, your abstention has the same effect as a vote against that proposal, except, however, an abstention has no effect on the election of directors.

If you hold your shares in street name andthey do not provide voting instructions to your brokerage firm, it may still be able to vote your shares with respect to certain “discretionary” (or routine) items, but it will not be allowed to vote your shares with respect to certain “non-discretionary” items. In the case of non-discretionary items, for which no instructions are received, the shares will be treated as “broker non-votes”. Shares that constitute broker non-votes will be counted as present at the meeting for the purpose of determining a quorum, but will not be considered entitled to vote on the proposal in question. Your broker does not have discretionary authority to vote such shares for the election of directors butas to such matter, will have discretionary authority to vote on the proposal relating to the ratification of the selection of the accounting firm. As a result, if you do not vote your street name shares, your broker has the authority to vote on your behalf with respect to Proposal 2 (the ratification of the selection of the accounting firm), but not with respect to Proposal 1 (the election of directors). We encourage you to provide instructions to your broker to vote your shares for the director nominees.

How many votes are needed to approve each Proposal?

Directors are elected by a plurality of the votes represented by the shares of common stock present at the meeting in person or by proxy.

This means that the five (5) director nominees with the most affirmative votes will be elected. Withheld votes, abstentions and broker non-votes will have no effect.

Approval is by the affirmative vote of a majority of the shares present in person or by proxy at the meeting and entitled to vote. Abstentions are counted and have the effect of a vote against the proposal because abstentions are deemed to be present and entitled to vote but are not counted toward the affirmative vote required to approve such proposal. Broker non-votes will not be entitledthe amendment to vote on this proposal. Therefore, under applicable Delaware law, broker non-votes will have noour Certificate of Incorporation to effect on the number of affirmative votes required to adopt such proposal.Reverse Stock Split.

WhatDissenter’s Right of Appraisal

No action will be taken in connection with the proposals described in this Proxy Statement for which Delaware law, our Certificate of Incorporation or Bylaws provide a right of a shareholder to dissent and obtain appraisal of or payment for such shareholder’s shares.

Householding of Proxy Materials

Some banks, brokers and other nominee record holders may be participating in the practice of “householding” Proxy Statements and Annual Reports. This means that only one copy of this Proxy Statement may have been sent to multiple shareholders in your household. We will promptly deliver a separate copy of either document to you if I return a proxy card, vote viayou call or write us at the Internetfollowing address or by telephone but do not make specific choices? What are the recommendationsphone number: 2166 Brighton Henrietta Townline Road, Rochester, NY 14623, Attention: Paul Travers, Chief Executive Officer. If you want to receive separate copies of our board of directors?

If you return a signedAnnual Report and dated proxy card or vote viaProxy Statement in the Internet without marking any voting selections, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the board of directors. The board’s recommendation is set forth together with the description of each proposal in this proxy statement. In summary, the board recommends a vote:

With respect to any other matter that properly comes before the meeting, the proxy holders will vote as recommended by the board of directorsfuture, or if no recommendation is given, in their own discretion.

Can I change my vote after submitting my proxy, voting via the Internet or by telephone?

Yes. You can revoke your proxy at any time before the final vote at the meeting. If you are a stockholder of record,receiving multiple copies and would like to receive only one copy for your household, you may revokeshould contact your proxy in any one of three ways:

If you hold your shares in street name, contact yourbank, broker or other nominee regarding how to revoke your proxyrecord holder, or you may contact us at the above address and change your vote.phone number.

How can I find outOther Matters

Our board of directors knows of no other business which will be presented for consideration at the resultsspecial meeting other than those matters described above. However, if any other business should come before the special meeting, it is the intention of the voting atperson named in the annual meeting?enclosed proxy card to vote, or otherwise act, in accordance with his best judgment on such matters.

Preliminary voting results will be announced at the annual meeting. Final voting results will be published in our report on Form 8-K within five (5) business days after the annual meeting.Solicitation of Proxies

What does it mean if I receive more than one proxy card?

If you receive more than one proxy card, your shares are registeredThe Company will pay the expenses of soliciting proxies, which we anticipate will total approximately $5,000. Proxies may be solicited on our behalf by directors, officers or employees of the Company, without additional remuneration, in more than one name or are registered in different accounts. Please complete, date, sign and return each proxy card, vote your shares via the Internetperson or by telephone, by mail, electronic transmission and facsimile transmission. Brokers, custodians and fiduciaries will be requested to forward proxy soliciting material to the owners of Common Stock held in their names and, as required by law, the Company will reimburse them for each proxy card you received to ensure that all of your shares are voted.their reasonable out-of-pocket expenses for this service.

Who is paying for this proxy solicitation?INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON

Vuzix will pay for the entire costNo director, executive officer, associate of soliciting proxies. In addition to these mailed proxy materials, our directors, officers and employees may also solicit proxies inany director, executive officer or any other person has any substantial interest, direct or indirect, by telephone,security holdings or by other means of communication. We will not pay our directors, officers and employees any additional compensation for soliciting proxies. We may also reimburse brokerage firms, banks and other agents for the cost of forwarding proxy materials to beneficial owners.

When are stockholder proposals due for next year’s annual meeting?

At our annual meeting each year, our board of directors submits to stockholders its nominees for election as directors. In addition, the board of directors may submit other matters to the stockholders for action at the annual meeting.

Our stockholders also may submit proposals for inclusionotherwise, in the proxy material. These proposals must meet the stockholder eligibility and other requirements of the Securities and Exchange Commission (the “SEC”). To be considered for inclusion in next year’s proxy materials, you must submit your proposal in writing by February 3, 2013 to our Corporate Secretary, Vuzix Corporation, 75 Town Centre Drive, Rochester, New York 14623.

In addition, our by-laws provide that a stockholder may present from the floor a proposalactions proposed hereunder that is not included inshared by all other stockholders.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Voting Securities

The number of outstanding shares of our Common Stock at the proxy statement ifclose of business on October 24, 2012, the stockholder delivers writtenrecord date for determining our stockholders who are entitled to notice of and to vote on the approval of the amendment to our Corporate Secretary not earlier than 120 days and not later 90 days before the first anniversaryCertificate of the preceding year’s annual meeting. The notice must set forth your name, address and number of shares of stock you hold, a description of the business to be brought before the meeting, the reasons for conducting such business at the annual meeting, any material interest you have in the proposal, and such other information regarding the proposal as would be required to be included in a proxy statement. We have received no such notice for the 2012 annual meeting. For the 2013 annual meeting of stockholders, written notice must be delivered to our Corporate Secretary at our principal office, 75 Town Centre Drive, Rochester, New York 14623, between February 22, 2013 and March 24, 2013.Incorporation, is 265,259,348.

Our by-laws also provide that if a stockholder intends to nominate a candidate for election as a director, the stockholder must deliver written notice of such intent to our Corporate Secretary. The notice must be delivered not earlier than 120 days and not later 90 days before the first anniversary of the preceding year’s annual meeting. The notice must set forth your name and address and number of shares of stock you own, the name and address of the person to be nominated, a description of all arrangements or understandings between such stockholder and each nominee and any other person (naming such person) pursuant to which the nomination is to be made by such stockholder, the nominee’s business address and experience during the past five years, any other directorships held by the nominee, the nominee’s involvement in certain legal proceedings during the past ten years and such other information concerning the nominee as would be required to be included in a proxy statement soliciting proxies for the election of the nominee. In addition, the notice must include the consent of the nominee to serve as a director if elected. We have received no such notice for the 2012 annual meeting. For the 2013 annual meeting of stockholders, written notice must be delivered to our Corporate Secretary at our principal office, 75 Town Centre Drive, Rochester, New York 14623, between February 22, 2013 and March 24, 2013.

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENTBeneficial Ownership of Directors, Officers and 5% Stockholders

The following table showssets forth information regarding the amountbeneficial ownership of our common stock beneficially ownedCommon Stock as of April 28,October 24, 2012 by (i)(a) each person or group as those terms are used in Section 13(d)(3) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), believedwho is known by us to beneficially own 5% or more than 5% of our common stock, (ii)Common Stock, (b) each of our directors (iii) each of ourand named executive officers, named in the Summary Compensation Table, and (iv)(c) all of our directors and executive officers as a group. Except as otherwise noted, each person named in the table has sole voting and investment power with respect to all shares shown as beneficially owned by them, subject to applicable community property laws.

| Name and Addresses of Beneficial Owner(1) | Shares Beneficially Owned(2) | Percent of Outstanding Shares Beneficially Owned(3) | Shares Beneficially Owned (2) | Percent of Outstanding Shares Beneficially Owned (3) | ||||||||||||

| Paul J. Travers | 77,544,015 | (4) | 28.54 | % | 77,544,015 | (4) | 28.65 | % | ||||||||

| Grant Russell | 13,729,649 | (5) | 5.14 | % | 13,729,649 | (5) | 5.14 | % | ||||||||

| William Lee | 704,000 | (5) | * | 792,000 | (6) | * | ||||||||||

| Frank Zammataro | 450,000 | (7) | * | |||||||||||||

| Richard Conway | 46,517,695 | (8) | 14.92 | %* | ||||||||||||

| Michael Scott | 0 | 0 | ||||||||||||||

| LC Capital Master Fund Ltd. | 46,191,220 | (7) | 14.83 | % | ||||||||||||

| José Cecin | 1,000,000 | (7) | * | 1,000,000 | (8) | * | ||||||||||

| Michael McCrackan | 1,000,000 | (7) | * | 1,000,000 | (8) | * | ||||||||||

| Paul Churnetski | 18,511,984 | 6.98 | % | 17,542,777 | 6.61 | % | ||||||||||

| Directors and executive officers as a group (6 people) | 94,427,663 | (9) | 34.17 | % | 94,515,663 | (9) | 33.79 | % | ||||||||

*less than 1.0%

| (1) | The address for each person is c/o Vuzix Corporation, |

| (2) | We have determined beneficial ownership in accordance with the rules of the SEC. These rules generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities. In addition, the rules include shares of |

| (3) | The percentage of shares beneficially owned is based on 265,259,348 shares of our |

| (4) | Includes shares held by the Travers Family Trust over which Mr. Travers may be deemed to hold voting and dispositive power, and (i) 1,705,058 shares issuable to Mr. Travers and his son upon exercise of options granted under our 2007 option plan and (ii) 3,730,429 shares issuable to Mr. Travers upon the conversion of amounts owed for deferred compensation and accrued |

| (5) | Includes shares held by Mr. Russell’s son and (i) 328,423 shares issuable upon exercise of options granted under our 2007 option plan and (ii) 50,000 shares issuable to Mr. Russell’s son upon exercise of warrants to purchase |

| Includes shares held directly by Mr. Lee and by Mr. Lee’s wife and minor daughter and (i) 450,000 shares issuable upon exercise of options granted under our 2009 option plan and (ii) 75,000 shares issuable to Mr. Lee, his wife and minor daughter upon exercise of warrants to purchase |

| (7) |

| Represents convertible debt and warrants issued to LC Capital Master Fund, Ltd. |

| Represents shares of our Common Stock issuable upon exercise of options granted under our 2009 option plan | ||

| (9) | Includes (i) 4,933,481 shares issuable upon exercise of options granted under our 2007 and 2009 option plans and (ii) 52,645,206 shares issuable upon exercise of warrants to purchase |

PROPOSAL ONE— AMENDMENT TO THE COMPANY’S CERTIFICATE OF

INCORPORATION TO EFFECT A REVERSE STOCK SPLIT OF COMMON STOCK

Our board of directors has adopted resolutions (1) declaring that submitting an amendment to the Company’s Certificate of Incorporation to effect the Reverse Stock Split of our issued and outstanding Common Stock, as described below, was advisable and (2) directing that a proposal to approve the Reverse Stock Split be submitted to the holders of our Common Stock for their approval.

Section 16(a) Beneficial Ownership Reporting ComplianceThe form of the proposed amendment to the Company’s Certificate of Incorporation to effect a reverse stock split of our issued and outstanding Common Stock will be substantially as set forth on Appendix A (subject to any changes required by applicable law). If approved by our stockholders, the Reverse Stock Split proposal would permit (but not require) our board of directors to effect a reverse stock split of our issued and outstanding Common Stock at any time prior to June 30, 2013 by a ratio of not less than one-for-twenty-five and not more than one-for-one hundred and fifty, with the exact ratio to be set at a whole number within this range as determined by our board of directors in its sole discretion. We believe that enabling our board of directors to set the ratio within the stated range will provide us with the flexibility to implement the Reverse Stock Split in a manner designed to maximize the anticipated benefits for our stockholders. In determining a ratio, if any, following the receipt of stockholder approval, our board of directors may consider, among other things, factors such as:

| · | the initial listing requirements of various stock exchanges; |

| · | the historical trading price and trading volume of our Common Stock; |

| · | the number of shares of our Common Stock outstanding; |

| · | the then-prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Reverse Stock Split on the trading market for our Common Stock; |

| · | the anticipated impact of a particular ratio on our ability to reduce administrative and transactional costs; and |

| · | prevailing general market and economic conditions. |

Our board of directors reserves the right to elect to abandon the Reverse Stock Split, including any or all proposed reverse stock split ratios, if it determines, in its sole discretion, that the Reverse Stock Split is no longer in the best interests of the Company and its stockholders.

Section 16(a)Depending on the ratio for the Reverse Stock Split determined by our board of directors, no less than twenty-five and no more than one hundred and fifty shares of existing Common Stock, as determined by our board of directors, will be combined into one share of Common Stock. Any fractional shares will be rounded up to the next whole number. The amendment to our Certificate of Incorporation to effect a reverse stock split, if any, will include only the reverse stock split ratio determined by our board of directors to be in the best interests of our stockholders and all of the Securities Exchange Actother proposed amendments at different ratios will be abandoned.

Background and Reasons for the Reverse Stock Split; Potential Consequences of 1934the Reverse Stock Split

Our board of directors is submitting the Reverse Stock Split to our stockholders for approval with the primary intent of increasing the market price of our Common Stock to enhance our ability to meet the initial listing requirements of The NASDAQ Capital Market and to make our Common Stock more attractive to a broader range of institutional and other investors. The Company currently does not have any plans, arrangements or understandings, written or oral, to issue any of the authorized but unissued shares that would become available as a result of the Reverse Stock Split. In addition to increasing the market price of our Common Stock, the Reverse Stock Split would also reduce certain of our costs, as discussed below. Accordingly, for these and other reasons discussed below, we believe that effecting the Reverse Stock Split is in the Company’s and our stockholders’ best interests.

We believe that the Reverse Stock Split will enhance our ability to obtain an initial listing on The NASDAQ Capital Market. The NASDAQ Capital Market requires, our directorsamong other items, an initial bid price of least $4.00 per share and executive officers, and persons who own more than 10%following initial listing, maintenance of a registered classcontinued price of at least $1.00 per share. Reducing the number of outstanding shares of our equity securities,Common Stock should, absent other factors, increase the per share market price of our Common Stock, although we cannot provide any assurance that our minimum bid price would remain following the Reverse Stock Split over the minimum bid price requirement of any such stock exchange.

Additionally, we believe that the Reverse Stock Split will make our Common Stock more attractive to file witha broader range of institutional and other investors, as we have been advised that the SEC reportscurrent market price of ownershipour Common Stock may affect its acceptability to certain institutional investors, professional investors and changesother members of the investing public. Many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in ownershiplow-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. In addition, some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Moreover, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of common stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. We believe that the Reverse Stock Split will make our Common Stock a more attractive and our other equity securities. Officers, directors and greater than 10% stockholders are required by SEC regulations to furnish us with copiescost effective investment for many investors, which will enhance the liquidity of all Section 16(a) forms they file. LC Capital Master Fund, Ltd acquired beneficial ownership of 15.0%the holders of our common stock on December 23, 2010Common Stock.

Reducing the number of outstanding shares of our Common Stock through the Reverse Stock Split is intended, absent other factors, to increase the per share market price of our Common Stock. However, other factors, such as was reportedour financial results, market conditions and the market perception of our business may adversely affect the market price of our Common Stock. As a result, there can be no assurance that the Reverse Stock Split, if completed, will result in the intended benefits described above, that the market price of our Common Stock will increase following the Reverse Stock Split or that the market price of our Common Stock will not decrease in the future. Additionally, we cannot assure you that the market price per share of our Common Stock after a Reverse Stock Split will increase in proportion to the reduction in the number of shares of our Common Stock outstanding before the Reverse Stock Split. Accordingly, the total market capitalization of our Common Stock after the Reverse Stock Split may be lower than the total market capitalization before the Reverse Stock Split.

Procedure for Implementing the Reverse Stock Split

The Reverse Stock Split, if approved by itsour stockholders, would become effective upon the filing (the “Effective Time”) of a certificate of amendment to our Certificate of Incorporation with the SECSecretary of State of the State of Delaware. The exact timing of the filing of the certificate of amendment that will effect the Reverse Stock Split will be determined by our board of directors based on Schedule 13D.

SEC regulations require usits evaluation as to identify any one who filed a required report late duringwhen such action will be the most recent fiscal year. Based solely on review of the copies of such reports furnishedadvantageous to the Company and written representations that no other reports were required during the year ended December 31, 2011, and we believe that, during 2011, all of our directors and executive officers complied with the reporting requirements of Section 16(a).

PROPOSAL 1

ELECTION OF DIRECTORS

The number of directors is established by the board and is currently fixed at five (5). At this annual meeting, five (5) persons, comprising the entire membership of the Board of Directors, are to be elected. Each elected director will serve until the Company's next annual meeting of shareholders and until a successor is elected and qualified. Messrs. Travers, Russell, Lee and Cecin were elected by the stockholders at the last annual meeting. Messrs. Scott has been nominated for election as a director by the stockholders for the first time at this annual meeting.

It is intended that the accompanying proxy will be voted in favor of the five (5) persons listed below to serve as directors unless the stockholder indicates to the contrary on the proxy. All nominees have consented to serve if elected. We expect that each of the nominees will be available for election, but if any of them is not a candidate at the time the election occurs, it is intended that such proxy will be voted for the election of another nominee to be designated by the board to fill any such vacancy.

For the election of directors, only proxies and ballots, Internet votes of telephone votes marked “FOR all nominees”, “WITHHELD for all nominees” or specifying that votes be withheld for one or more designated nominees are counted to determine the total number of votes cast; votes that are withheld are excluded entirely from the vote and will have no effect . Abstentions will have no effect on the vote for the election of directors. Directors are elected by a plurality of the votes cast. This means that the five (5) nominees who receive the most affirmative votes will be elected.

The term of office of each person elected as a director will continue until the next annual meeting or until his or her successor has been elected and qualified, or until the director’s death, resignation or removal.

The Board of Directors unanimously recommends a vote FOR the election as directors the nominees listed below.

Nominees for Election as Directors

The names of the nominees, their ages as of April 30, 2012, and certain information about their business experience during the past five years and their directorships of other publicly held corporations are set forth below.

Paul J. Travers, was the founder of Vuzix and has served as our President and Chief Executive Officer since 1997 and as a member ofstockholders. In addition, our board of directors since November 1997. Priorreserves the right, notwithstanding stockholder approval and without further action by the stockholders, to elect not to proceed with the Reverse Stock Split if, at any time prior to filing the amendment to the formationCompany’s Certificate of Vuzix, Mr. Travers founded both e-Tek Labs, Inc. and Forte Technologies Inc. He has been a driving force behind the development of our products. With more than 25 years’ experience in the consumer electronics field, and 20 years’ experience in the virtual reality and virtual display fields, he is a nationally recognized industry expert. He holds an Associate degree in engineering science from Canton, ATC and a Bachelor of Science degree in electrical and computer engineering from Clarkson University. Mr. Travers resides in Honeoye Falls, New York, United States.

Grant Russell,Chief Financial Officer, Executive Vice-President. Mr. Russell has served as our Chief Financial Officer since 2000 and assumed the role of Executive Vice-President in 2008. Mr. Russell holds professional accounting designations in both Canada and the USA, and has extensive expertise in finance and pubic start-ups. He has successfully founded, operated and sold two prior companies focused on the computer hardware and software consumer markets.

William Lee. Mr. Lee has served as the CFO of several companies and has served on the boards of directors of several publicly-held corporations, including consumer software products firms [See Reg S-X]. Mr. Lee serves as Chairman of the Audit Committee. Mr. Lee’s experience is helpful to us in evaluating strategic investment opportunities.

José A. Cecin. Mr. Cecin has served as the COO and has served on the boards of directors of several publicly-held corporations, including several technology firms [see Reg S-X]. Mr. Cecin is an Electrical Engineer with defense schooling and service record and provides the Company advice on its dealings with US Defense and Government customers.

Michael Scott. Mr. Scott is currently a Professor of Law. Mr. Scott specializes in practicing and teaching Technology and Intellectual Property law and will be a resource to the Board in connection with the Company’s dealings with its intellectual properties and licensing strategies.

The board of directors considers diversity in the makeup of the Board when evaluating director candidates. Characteristics that it considers include nature and breadth of business experience, education, professional certification, gender, race, education and nationality.

Background of Nominees

Paul J. Travers, age 50, was the founder of Vuzix and has served as our President and Chief Executive Officer since 1997 and as a member ofIncorporation, our board of directors, since November 1997. Prior toin its sole discretion, determines that it is no longer in our best interest and the formation of Vuzix, Mr. Travers founded both e-Tek Labs, Inc. and Forte Technologies Inc. He has been a driving force behind the developmentbest interests of our products. With more than 25 years’ experience instockholders to proceed with the consumer electronics field, and 20 years’ experience inReverse Stock Split. If a certificate of amendment effecting the virtual reality and virtual display fields, he is a nationally recognized industry expert. He holds an Associate degree in engineering science from Canton, ATC and a BachelorReverse Stock Split has not been filed with the Secretary of Science degree in electrical and computer engineering from Clarkson University. Mr. Travers resides in Honeoye Falls, New York, United States.

Grant Russell, age 59, has served as our Chief Financial Officer since 2000 and as a memberState of the State of Delaware by the close of business on June 30, 2013, our board of directors since April 3, 2009. From 1997 to 2004, Mr. Russell developed and subsequently sold a successful software firm and a new concept computer store and cyber café. In 1984, he co-founded Advanced Gravis Computer (Gravis), which, under his leadership as President, grew to becomewill abandon the world’s largest PC and Macintosh joystick manufacturer with sales of $44,000,000 worldwide and 220 employees. Gravis was listed on NASDAQ and the TorontoReverse Stock Exchange. In September 1996 it was acquired by a US-based Fortune 100 company in a successful public tender offer. Mr. Russell holds a Bachelor of Commerce degree in finance from the University of British Columbia and is both a US Certified Public Accountant and a Canadian Chartered Accountant. Mr. Russell resides in Vancouver, British Columbia, Canada.Split.

William Lee, age 59, has served as a memberEffect of the Reverse Stock Split on Holders of Outstanding Common Stock

Depending on the ratio for the Reverse Stock Split determined by our board of directors, since June 26, 2009. Mr. Lee has been self-employeda minimum of twenty-five and a maximum of one hundred and fifty shares of existing Common Stock will be combined into one new share of Common Stock. The table below shows, as of October 24, 2012, the number of outstanding shares of Common Stock (excluding Treasury shares) that would result from the listed hypothetical reverse stock split ratios (without giving effect to the treatment of fractional shares):

| Reverse Stock Split Ratio | Approximate Number of Outstanding Shares of Common Stock Following the Reverse Stock Split | |||

| 1-for-25 | 10,610,374 | |||

| 1-for-50 | 5,305,187 | |||

| 1-for-60 | 4,420,990 | |||

| 1-for-70 | 3,789,420 | |||

| 1-for-80 | 3,315,742 | |||

| 1-for-90 | 2,947,326 | |||

| 1-for-100 | 2,652,594 | |||

| 1-for-125 | 2,122,075 | |||

| 1-for 150 | 1,768,396 | |||

The actual number of shares issued after giving effect to the Reverse Stock Split, if implemented, will depend on the reverse stock split ratio that is ultimately determined by our board of directors.

The Reverse Stock Split will affect all holders of our Common Stock uniformly and will not affect any stockholder’s percentage ownership interest in the Company, except that as described below in “— Fractional Shares,” record holders of Common Stock otherwise entitled to a fractional share as a financial consultant since May 2008. From January 2006 to May 2008, he served as Chief Financial Officer of Jinshan Gold Mines Inc., a mining company listed on the Toronto Stock Exchange. From July 2004 to January 2006, he was engaged as a business analyst for Ivanhoe Energy Inc., a Toronto Stock Exchange and NASDAQ listed company, and Ivanhoe Mines Ltd. Vancouver, an independent international heavy oil development and production company with operations in Canada, the United States, China, and Ecuador and listed on the New York and Toronto Stock Exchanges. Mr. Lee spent nine years engaged in the practice of public accounting with the firm of Deloitte & Touche. Mr. Lee is a memberresult of the Institute of Chartered Accountants of British Columbia and holds a Bachelor of Commerce degree from the University of British Columbia. Mr. Lee also currently serves as a director of Tinka Resources Ltd., Halo Resources Ltd., and Riverside Resources Inc., all of which are listed on the TSX-V. Mr. Lee resides in Delta, British Columbia, Canada.

José A. Cecin, age 48, was recently the Executive Vice President and Chief Operating Officer of RCN Corporation. Previously, he was a Managing Director of BB&T Capital Markets where he was the Group Head of the firm's Communications Investment Banking practice. He has served as a director of several publicly traded companies including RCN, Arbinet Corporation, SkyTerra Communications and NEON Group, Inc. Mr. Cecin earned a BS degree in Electrical Engineering from the United States Military Academy at West Point and an MBA from Stanford University. Mr. Cecin is the second of the two director nominees designated by Lampe Conway pursuantReverse Stock Split will be rounded up to the loan agreement betweennext whole number. In addition, the Company and LC Capital Master Fund Ltd. (LC)Reverse Stock Split will not affect any stockholder’s proportionate voting power (subject to the treatment of fractional shares).

Michael Scott, age 66,The Reverse Stock Split may result in some stockholders owning “odd lots” of less than 100 shares of Common Stock. Odd lot shares may be more difficult to sell, and brokerage commissions and other costs of transactions in odd lots are generally somewhat higher than the costs of transactions in “round lots” of even multiples of 100 shares.

After the Effective Time, our Common Stock will have new Committee on Uniform Securities Identification Procedures (CUSIP) numbers, which is a Professornumber used to identify our equity securities, and stock certificates with the older CUSIP numbers will need to be exchanged for stock certificates with the new CUSIP numbers by following the procedures described below. After the Reverse Stock Split, we will continue to be subject to the periodic reporting and other requirements of Law at the Southwestern Law School in Los Angeles, CA. Previously, he was Partner at various legal firms specializing in Technology and IP Practices, including Perkins Coie LLP, and Graham & James. He previously served on the board of Sanctuary Woods Multimedia, Inc., a publicly traded company. He is the author of 7 books on Technology Law as well as the writer of numerous legal IP-related articles published in journals, newspapers and magazines. He is the Founder and Editor-in-Chief of the E-Commerce Law Report and the Cyberspace Lawyer.

Information Regarding the Board and its Committees

Director Meeting and Attendance

During 2011, our board held three (3) in-person regular meetings, five (5) conference-call meetings, and acted three (3) times by unanimous written consent. In addition, the directors considered Company matters and had frequent communication with each other apart from the formal meetings.

Board Independence

Our board has determined that each of our directors other than Mr. Travers and Mr. Russell is an independent director as defined by Rule 10A-3 promulgated by the Securities and Exchange Act pursuant to the Securities Exchange Act of 1934, as amended. We believeOur Common Stock will continue to be listed on the Over the Counter Bulletin Board under the symbol “VUZI”, on the TSXV under the symbol “VZX” and on the Frankfurt Stock Exchange under the symbol “V7X”, subject to any decision of our Board of Directors to list our securities on another stock exchange.

Beneficial Holders of Common Stock (i.e. stockholders who hold in street name)

Upon the implementation of the Reverse Stock Split, we intend to treat shares held by stockholders through a bank, broker, custodian or other nominee in the same manner as registered stockholders whose shares are registered in their names. Banks, brokers, custodians or other nominees will be instructed to effect the Reverse Stock Split for their beneficial holders holding our Common Stock in street name. However, these banks, brokers, custodians or other nominees may have different procedures than registered stockholders for processing the Reverse Stock Split. Stockholders who hold shares of our Common Stock with a bank, broker, custodian or other nominee and who have any questions in this regard are encouraged to contact their banks, brokers, custodians or other nominees.

Registered “Book-Entry” Holders of Common Stock (i.e. stockholders that we are compliantregistered on the transfer agent’s books and records but do not hold stock certificates)

Certain of our registered holders of Common Stock may hold some or all of their shares electronically in book-entry form with the independence criteriatransfer agent. These stockholders do not have stock certificates evidencing their ownership of the Common Stock. They are, however, provided with a statement reflecting the number of shares registered in their accounts.

Stockholders who hold shares electronically in book-entry form with the transfer agent will not need to take action (the exchange will be automatic) to receive whole shares of post-Reverse Stock Split Common Stock, subject to adjustment for boardstreatment of directors under applicable lawsfractional shares.

Holders of Certificated Shares of Common Stock

Stockholders holding shares of our Common Stock in certificated form will be sent a transmittal letter by our transfer agent after the Effective Time. The letter of transmittal will contain instructions on how a stockholder should surrender his, her or its certificate(s) representing shares of our Common Stock (the “Old Certificates”) to the transfer agent in exchange for certificates representing the appropriate number of whole shares of post-Reverse Stock Split Common Stock (the “New Certificates”). No New Certificates will be issued to a stockholder until such stockholder has surrendered all Old Certificates, together with a properly completed and regulations. The board may meet independentlyexecuted letter of management as required. Althoughtransmittal, to the transfer agent. No stockholder will be required to pay a transfer or other fee to exchange his, her or its Old Certificates. Stockholders will then receive a New Certificate(s) representing the number of whole shares of Common Stock that they are permitted to do so, the independent directors have not held separately scheduled meetings but have had executive sessions at the conclusionsentitled as a result of the regularly scheduled meetings atReverse Stock Split, subject to the treatment of fractional shares described below. Until surrendered, we will deem outstanding Old Certificates held by stockholders to be cancelled and only to represent the number of whole shares of post-Reverse Stock Split Common Stock to which non-independent directors and membersthese stockholders are entitled, subject to the treatment of managementfractional shares. Any Old Certificates submitted for exchange, whether because of a sale, transfer or other disposition of stock, will automatically be exchanged for New Certificates. If an Old Certificate has a restrictive legend on the back of the Old Certificate(s), the New Certificate will be issued with the same restrictive legends that are not in attendance.on the back of the Old Certificate(s).

Board Committees

We have an audit committee, a compensation committee and a nominating committee.

Audit CommitteeSTOCKHOLDERS SHOULD NOT DESTROY ANY STOCK CERTIFICATE(S) AND SHOULD NOT SUBMIT ANY STOCK CERTIFICATE(S) UNTIL REQUESTED TO DO SO.

Our audit committee consistsFractional Shares

We do not currently intend to issue fractional shares in connection with the Reverse Stock Split. Therefore, we will not issue certificates representing fractional shares. In lieu of William Leeissuing fractions of shares, we will round up to the next whole number.

Effect of the Reverse Stock Split on Employee Plans, Options, Restricted Stock Awards and Frank Zammataro, each of whom is a non-employee director. Mr. Lee isUnits, Warrants, and Convertible or Exchangeable Securities

Based upon the chairperson of our audit committee. Ourreverse stock split ratio determined by the board of directors, hasproportionate adjustments are generally required to be made to the per share exercise price and the number of shares issuable upon the exercise or conversion of all outstanding options, warrants, convertible or exchangeable securities entitling the holders to purchase, exchange for, or convert into, shares of Common Stock. This would result in approximately the same aggregate price being required to be paid under such options, warrants, convertible or exchangeable securities upon exercise, and approximately the same value of shares of Common Stock being delivered upon such exercise, exchange or conversion, immediately following the Reverse Stock Split as was the case immediately preceding the Reverse Stock Split. The number of shares deliverable upon settlement or vesting of restricted stock awards will be similarly adjusted, subject to our treatment of fractional shares. The number of shares reserved for issuance pursuant to these securities will be proportionately based upon the reverse stock split ratio determined that each member designeeby the board of directors, subject to our treatment of fractional shares.

Accounting Matters

The proposed amendment to the Company’s Certificate of Incorporation will not affect the par value of our audit committeeCommon Stock per share, which will remain $0.001 par value per share. As a result, as of the Effective Time, the stated capital attributable to Common Stock and the additional paid-in capital account on our balance sheet will not change due to the Reverse Stock Split. Reported per share net income or loss will be higher because there will be fewer shares of Common Stock outstanding.

Certain Federal Income Tax Consequences of the Reverse Stock Split

The following summary describes certain material U.S. federal income tax consequences of the Reverse Stock Split to holders of our Common Stock:

Unless otherwise specifically indicated herein, this summary addresses the tax consequences only to a beneficial owner of our Common Stock that is an independent directora citizen or individual resident of the United States, a corporation organized in or under the laws of the United States or any state thereof or the District of Columbia or otherwise subject to U.S. federal income taxation on a net income basis in respect of our Common Stock (a “U.S. holder”). A trust may also be a U.S. holder if (1) a U.S. court is able to exercise primary supervision over administration of such trust and one or more U.S. persons have the authority to control all substantial decisions of the trust or (2) it has a valid election in place to be treated as defineda U.S. person. An estate whose income is subject to U.S. federal income taxation regardless of its source may also be a U.S. holder. This summary does not address all of the tax consequences that may be relevant to any particular investor, including tax considerations that arise from rules of general application to all taxpayers or to certain classes of taxpayers or that are generally assumed to be known by Rule 10A-3 promulgatedinvestors. This summary also does not address the tax consequences to (i) persons that may be subject to special treatment under U.S. federal income tax law, such as banks, insurance companies, thrift institutions, regulated investment companies, real estate investment trusts, tax-exempt organizations, U.S. expatriates, persons subject to the alternative minimum tax, traders in securities that elect to mark to market and dealers in securities or currencies, (ii) persons that hold our Common Stock as part of a position in a “straddle” or as part of a “hedging,” “conversion” or other integrated investment transaction for federal income tax purposes, or (iii) persons that do not hold our Common Stock as “capital assets” (generally, property held for investment).

If a partnership (or other entity classified as a partnership for U.S. federal income tax purposes) is the beneficial owner of our Common Stock, the U.S. federal income tax treatment of a partner in the partnership will generally depend on the status of the partner and the activities of the partnership. Partnerships that hold our Common Stock, and partners in such partnerships, should consult their own tax advisors regarding the U.S. federal income tax consequences of the Reverse Stock Split.

This summary is based on the provisions of the Internal Revenue Code of 1986, as amended, U.S. Treasury regulations, administrative rulings and judicial authority, all as in effect as of the date of this proxy statement. Subsequent developments in U.S. federal income tax law,

including changes in law or differing interpretations, which may be applied retroactively, could have a material effect on the U.S. federal income tax consequences of the Reverse Stock Split.

PLEASE CONSULT YOUR OWN TAX ADVISOR REGARDING THE U.S. FEDERAL, STATE, LOCAL, AND FOREIGN INCOME AND OTHER TAX CONSEQUENCES OF THE REVERSE STOCK SPLIT IN YOUR PARTICULAR CIRCUMSTANCES UNDER THE INTERNAL REVENUE CODE AND THE LAWS OF ANY OTHER TAXING JURISDICTION.

U.S. Holders

The Reverse Stock Split should be treated as a recapitalization for U.S. federal income tax purposes. Therefore, a stockholder generally will not recognize gain or loss on the Reverse Stock Split, except to the extent of cash, if any, received in lieu of a fractional share interest in the post-Reverse Stock Split shares. The aggregate tax basis of the post-split shares received will be equal to the aggregate tax basis of the pre-split shares exchanged therefore (excluding any portion of the holder’s basis allocated to fractional shares), and the holding period of the post-split shares received will include the holding period of the pre-split shares exchanged. A holder of the pre-split shares who receives cash will generally recognize gain or loss equal to the difference between the portion of the tax basis of the pre-split shares allocated to the fractional share interest and the cash received. Such gain or loss will be a capital gain or loss and will be short term if the pre-split shares were held for one year or less and long term if held more than one year. No gain or loss will be recognized by us as a result of the SecuritiesReverse Stock Split.

No Appraisal Rights

Under Delaware law and Exchange Act pursuantour charter documents, holders of our Common Stock will not be entitled to dissenter’s rights or appraisal rights with respect to the Reverse Stock Split.

Board Recommendation

THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” APPROVAL OF AN AMENDMENT TO THE COMPANY’S CERTIFICATE OF INCORPORATION TO AUTHORIZE A REVERSE STOCK SPLIT OF OUR ISSUED AND OUTSTANDING COMMON STOCK.

****

AVAILABLE INFORMATION

We are currently subject to the information requirements of the Securities Exchange Act of 1934, as amended, and meetsin accordance therewith file periodic reports, Proxy Statements and other information with the requirementsSEC relating to our business, financial statements and other matters. Copies of financial literacy under SEC rulessuch reports, Proxy Statements and regulations. Mr. Lee serves as our audit committee financial expert, as defined under SEC rules. Our audit committee met four (4) times during 2011.

Our audit committee is responsible for, among other things:

Our board of directors has adopted a written charter for our audit committee, which is available on our website (www.vuzix.com).

Compensation Committee

Our compensation committee consists of Joe Cecin and Frank Zammataro, each of whom is a non-employee director. Mr. Zammataro isinformation may be copied (at prescribed rates) at the chairperson of our compensation committee. Our board of directors has determined that each member designee of our compensation committee is an independent director as defined by Rule 10A-3 promulgatedpublic reference room maintained by the Securities and Exchange Act pursuantCommission at 100 F Street NE, Washington DC 20549. For further information concerning the SEC’s public reference room, you may call the SEC at 1-800-SEC-0330. Some of this information may also be accessed on the World Wide Web through the SEC’s Internet address at http://www.sec.gov.

Requests for documents relating to the Securities Exchange Act of 1934, as amended. Our compensation committee met once in 2011.Company should be directed to:

Our compensation committee is responsible for, among other things:VUZIX CORPORATION

2166 Brighton Henrietta Townline Road

Our compensation committee may not delegate any of its authority to any other person. No compensation consultant was engaged to determine or recommend the amount or form of compensation paid to our executive officers in 2011. The compensation paid to our named executive officers for 2010 was determined by the employment agreements we entered into with those executives in August 2007. See “Compensation of Named Executive Officers and Directors – Employment Agreements.”Rochester, NY 14623

(585) 359-5900

Attention: Paul Travers

Our board of directors has adopted a written charter for our compensation committee, which is available on our website (www.vuzix.com).

Nominating Committee

Our nominating committee consists of Frank Zammataro, Joe Cecin, and William Lee each of whom is a non-employee member of our board of directors. Mr. Zammataro is the chairperson of our nominating committee. Our board of directors has determinedhopes that each member designee of our nominating committee is an independent director as defined by Rule 10A-3 promulgated by the Securities and Exchange Act pursuant to the Securities Exchange Act of 1934, as amended. Our board of directors has adopted a written charter for our nominating committee, which is available on our website (www.vuzix.com). Our nominating committee met once in 2011 and once in 2012.

Nominating Process

The process followed by the nominating and governance committee to identify and evaluate candidates includes requests to board members, the chief executive officer, and others for recommendations, meetings from time to time to evaluate any biographical information and background material relating to potential candidates and their qualifications, and interviews of selected candidates. Nominations of persons for election to our board may be made at a meeting of stockholders only (i) by or at the direction of the board; or (ii) by any stockholder who has complied with the notice procedures set forth in our bylaws and in the section entitled “Questions and Answers About This Proxy Material and Voting – When are stockholder proposals due for next year’s annual meeting?” In addition, stockholders who wish to recommend a prospective nominee for the nominating and governance committee’s consideration should submit the candidate’s name and qualifications to Secretary, 75 Town Centre Drive, Rochester, New York 14623.

In evaluating the suitability of candidates to serve on the board of directors, including stockholder nominees, the nominating committee seeks candidates who are independent as defined by Rule 10A-3 promulgated by the Securities and Exchange Act pursuant to the Securities Exchange Act of 1934, as amended and meet certain selection criteria established by the committee. The committee also considers an individual’s skills, character and professional ethics, judgment, leadership experience, business experience and acumen, familiarity with relevant industry issues, and other relevant criteria that may contribute to our success. This evaluation is performed in light of the skill set and other characteristics that would most complement those of the current directors, including the diversity, maturity, skills and experience of the board as a whole. The board seeks the best director candidates based on the skills and characteristics required without regard to race, color, national origin, religion, disability, marital status, age, sexual orientation, gender, gender identity and expression, or any other basis protected by federal, state or local law.

Corporate Governance and Related Matters

Board Leadership Structure

Our board is responsible for the selection of the chairman of the board and the chief executive officer. Our board does not have a policy on whether or not the roles of chief executive officer and chairman should be separate and, if they are to be separate, whether the chairman should be selected from the non-employee directors or be an employee. Currently our chief executive officer acts as chairman. Our board believes that Paul J. Travers, our founder and chief executive officer, is best situated to act as chairman of the board because he is the director most familiar with the Company’s business and industry and is therefore best able to identify the strategic priorities to be discussed by the board.

Our board believes that the most effective board structure is one that emphasizes board independence and ensures that the board’s deliberations are not dominated by management. Three of our five current directors qualify as independent directors within the meaning of Rule 10A-3 promulgated by the Securities and Exchange Act pursuant to the Securities Exchange Act of 1934, as amended). Each of our standing board committees is comprised of only independent directors, including our nominating committee, which is charged with annually evaluating and reporting to the board on the performance and effectiveness of the board. Our board has not appointed a lead independent director.

Our Board’s Role in Risk Oversight

Our management is responsible for risk management on a day-to-day basis. The role of our board and its committees includes overseeing the risk management activities of management. Our board oversees our risk management processes directly and through its committees. The audit committee assists the board in fulfilling its oversight responsibilities with respect to risk management in the areas of financial reporting, internal controls and compliance with legal and regulatory requirements, and discusses policies with respect to risk assessment and risk management, including guidelines and policies to govern the process by which our exposure to risk is handled. The compensation committee assists the board in fulfilling its oversight responsibilities with respect to the management of risks arising from our compensation policies and programs. The nominating committee assists the board in fulfilling its oversight responsibilities with respect to the management of risks associated with board organization, membership and structure and succession planning for our directors.

Code of Ethics

Our board of directors has adopted a written code of ethics, the Code of Business Conduct and Ethics, which applies to all of our directors, officers (including our chief executive officer and chief financial officer) and employees.

We make available to the public various corporate governance information on our website (www.vuzix.com) under “Investors – Corporate Governance.” Information on our website includes our Code of Business Conduct and Ethics, the Audit Committee Charter, the Compensation Committee Charter, the Nominating Committee Charter, and our Insider Trading Policy. Information regarding any amendments to, or waiver from, the Code of Business Conduct and Ethics will also be posted on our website.

Communications with the Board of Directors

Stockholders and other parties may communicate directly with the board of directors or the relevant board member by addressing communications to:

[Name of director(s) or Board of Directors]

Vuzix Corporation

c/o Corporate Secretary

75 Town Centre Drive

Rochester, New York 14623

All stockholder correspondence will be compiled by our corporate secretary and forwarded as appropriate.

Director Attendance at Annual Meetings

We have scheduled a board of directors meeting in conjunction with our annual meeting of stockholders and, while we do not have a formal policy regarding attendance at annual meetings, we as a general matter expect that the directorsshareholders will attend the annualspecial meeting. Three of the five director nominees for 2011 attended our 2011 annual meeting.

PROPOSAL 2

RATIFICATION OF THE SELECTION OF THE COMPANY’S

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2012

The audit committee has selected the accounting firm of EFP Rotenberg, LLP to serve as the Company’s independent registered public accounting firm for the year ending December 31, 2012. EFP Rotenberg, LLP (and its predecessor, Rotenberg & Co., LLP) has served as the Company’s independent registered public accounting firm since August 2009 and is considered by the audit committee, the board and management of the Company to be well qualified. The stockholders are being asked to ratify the audit committee’s appointment of EFP Rotenberg, LLP. If the stockholders fail to ratify this appointment, the audit committee may, but is not required to, reconsider whether to retain that firm. Even if the appointment is ratified, the audit committee in its discretion may direct the appointment of a different accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and its stockholders. A representative of EFP Rotenberg, LLP will be present at the annual meeting and will be given the opportunity to make a statement if he or she so desires and will be available to respond to appropriate questions.

Fees Paid to EFP Rotenberg, LLP